west st paul mn sales tax rate

350k Salary Example West Saint Paul Minnesota Sales Tax Comparison Calculator for 202223 The West Saint Paul Minnesota Sales Tax Comparison Calculator allows you to. While many other states allow counties and other localities to collect a local option sales tax.

Local Sales Tax Saint Peter Mn

Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure.

. West Saint Paul in Minnesota has a tax rate of 713 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in West Saint Paul totaling 025. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. State Tax Rates.

The STAR program funds the. 2020 rates included for use while preparing your income tax. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7625. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. This is the total of state county and city sales tax.

The results do not include special local taxessuch as admissions entertainment liquor. Paul use tax is line number 634. The local sales tax rate in Saint Paul Minnesota is 7875 as of June 2022.

The minimum combined 2022 sales tax rate for West Saint Paul Minnesota is. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. What is the sales tax rate in West Saint Paul Minnesota.

Rates include state county and city taxes. What is the sales tax rate in South Saint Paul Minnesota. The Saint Paul Minnesota sales tax is 688 the same as the Minnesota state sales tax.

05 percent West St. This tax is in addition to the. The average cumulative sales tax rate in Saint Paul Minnesota is 758.

Paul sales tax is line number 633. Apply the combined 7375 percent rate plus any other local. The latest sales tax rate for Saint Paul MN.

On January 1 2000 the 050 local option sales and use tax was implemented within the City of Saint Paul to fund the Sales Tax Revitalization STAR program. The West Saint Paul Minnesota sales tax is 713 consisting of 688 Minnesota state sales tax and 025 West Saint Paul local sales taxesThe local sales tax consists of a 025 special. The current total local sales tax rate in West Saint Paul MN is 7625.

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Minnesota Sales Tax Guide For Businesses

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Minnesota Tax Rates Rankings Minnesota State Taxes Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Taxation Of Social Security Benefits Mn House Research

Dakota County Mn Property Tax Calculator Smartasset

Dakota County Mn Property Tax Calculator Smartasset

Minnesota Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

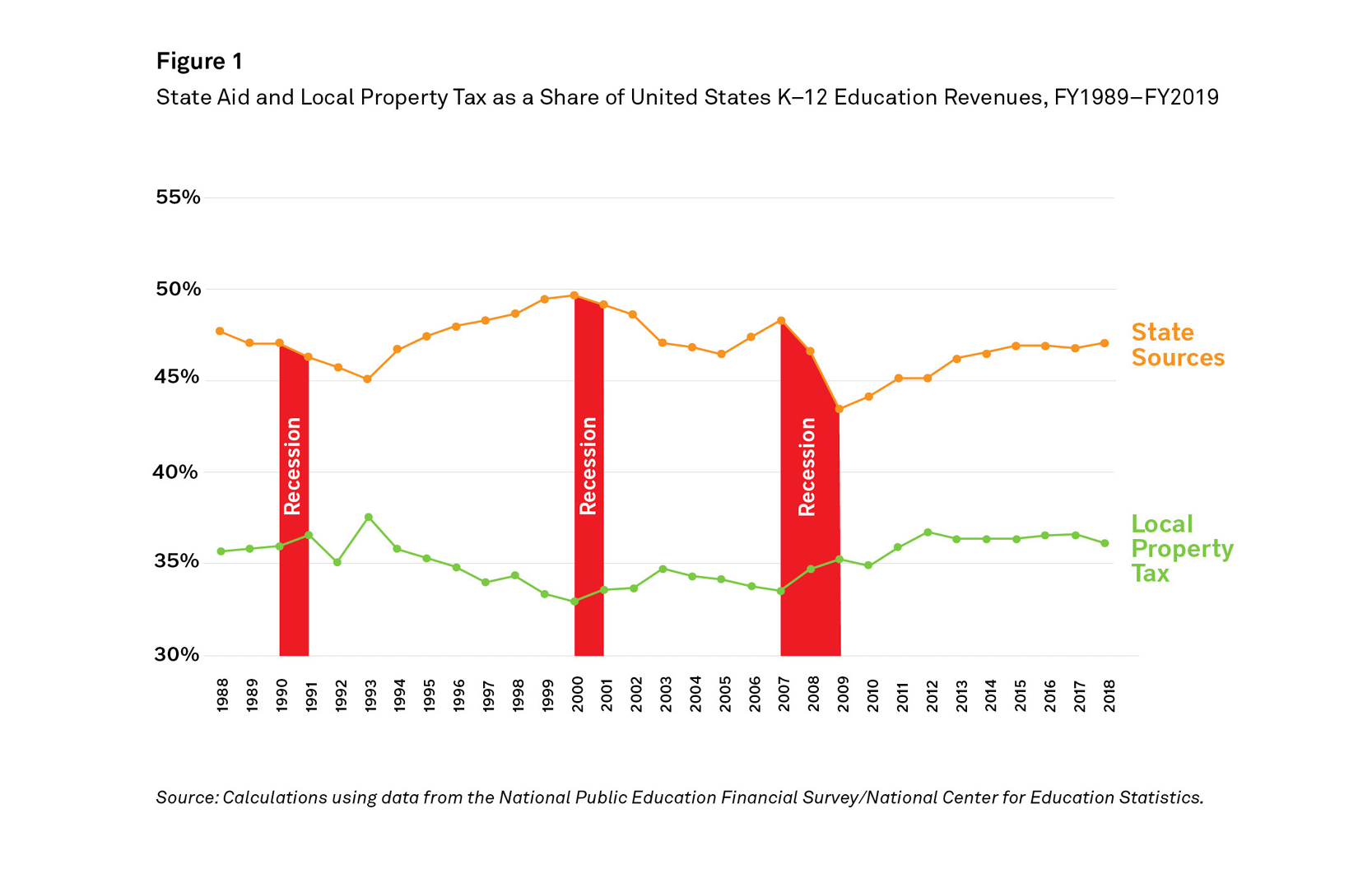

Public Schools And The Property Tax A Comparison Of Education Funding Models In Three U S States Lincoln Institute Of Land Policy